BNP Paribas US Patriot Technologies RC5 AR Index

(”US Patriot Technologies Index” or “the Index”)

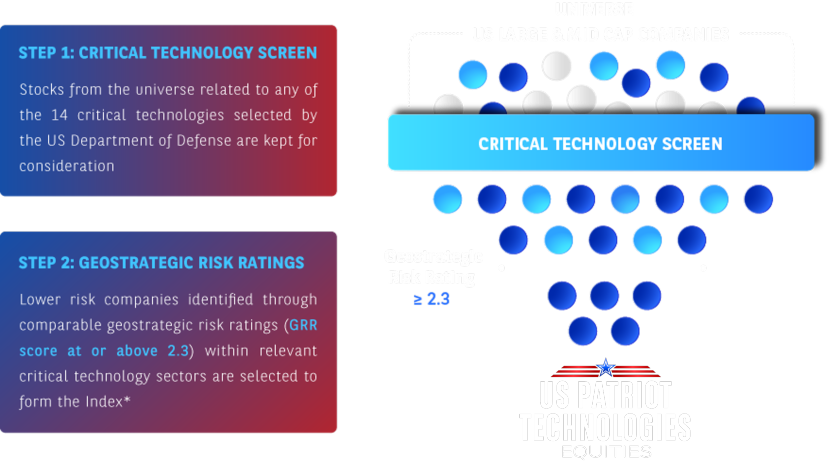

The US Patriot Technologies Index aims to offer exposure to US companies that are aligned with the United States Department of Defense’s critical technologies list and with low geostrategic risk and foreign influence, via a rules-based index that aims to provide a balance between growth potential and asset protection. It features a daily volatility control mechanism, which targets an annualised realised volatility of 5%.

For a list of selected risks and considerations with the US Patriot Technologies Index, please click here.

Click on the video below to learn more about the US Patriot Technologies Index.

THE US PATRIOT TECHNOLOGIES INDEX INCLUDES

A market cap weighted portfolio is targeted by the US Patriot Technologies Index. It aims to minimise geostrategic risk from sanctions, trade, and conflict, and aims to be aligned with US modernisation priorities.

*J.H. Whitney is a geopolitical risk consulting firm whose proprietary geostrategic risk scoring methodology helps inform the equity portion of the Index.

Risk Reduction Mechanism

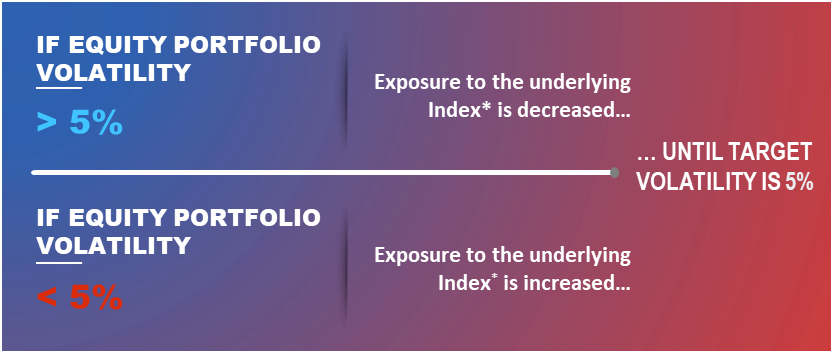

On a daily basis, the US Patriot Technologies Index targets a Realised Volatility of 5%, through a volatility control mechanism implemented during the Portfolio Construction.

If the Realised Volatility of the Underlying Index* exceeds the Target Volatility of 5%, the exposure to the Underlying Index is reduced proportionately;

If the Realised Volatility of the Underlying Index* is below the Target Volatility of 5%, the exposure to the Underlying Index is increased proportionately, up to a maximum of 100%.

*Solactive Whitney U.S. Patriot Technology Index TR

US Patriot Technologies Index, the strategy that fuses patriotism and innovation, showcasing critical and emerging dual-use technologies that can drive breakthroughs in both national security and economic prosperity.