BNP PARIBAS TECHNOLOGY BALANCED 7 INDEX

The BNP Paribas Technology Balanced 7 Index (“the Index”) is a rules-based Index that aims to provide a balance between growth potential and asset protection by offering exposure to Nasdaq-100 Index® futures, and adding an additional layer of risk control through the BNP Paribas volatility control overlay.

For a list of selected risk and considerations with the BNP Paribas Technology Balanced 7 Index, please click here

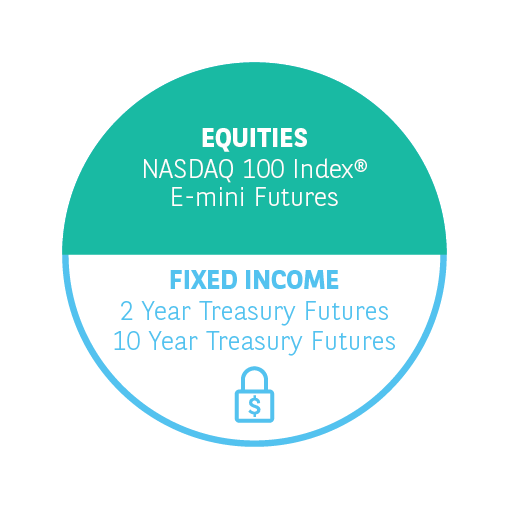

THE BNP PARIBAS TECHNOLOGY BALANCED 7 INDEX Includes

The equity portion of the BNP Paribas Technology Balanced 7 Index follows the Nasdaq-100 Index® by seeking exposure to its e-mini futures contracts1.

The Nasdaq-100 Index® is one of the world’s preeminent large-cap growth indices and is home to some of the world’s most innovative companies.

Allocated towards 100 of the largest US and international non-financial companies listed in the Nasdaq Stock Market based on market capitalization, it includes top performing industries such as:

1 E-mini refers to an electronically-traded futures contract that is a fraction of the size of a standard contract and tends to be very liquid. The BNP Paribas Technology Balanced 7 Index aims to provide continuous exposure to the E-mini Nasdaq-100 Index® Futures Contracts with the nearest quarterly expiration date.

In an effort to hedge large market movements, on a daily basis, the Index methodology adjusts exposure among e-mini Nasdaq-100 Index® futures, US treasury futures1, and a hypothetical cash position to target an annualized realized volatility of 7%.

If the volatility level of the equity portion of the Index is higher than 7%, the Index is intended to shift exposure to more stable components by reducing the weight of the equity portion and rebalancing it with fixed income.

If the volatility of the portfolio composed of equity and fixed income is still higher than 7%, the Index is designed to reduce the weight of those components and rebalance the portfolio with a non-remunerable hypothetical cash position.

1 Exposure to US treasury futures is designed to either go towards 10 year US Treasury Futures or 2 Year US Treasury Futures, depending on performance. The weights of the 10 Year US Treasury Futures and the 2 Year US Treasury Futures can only change by a maximum of 20% per day.

Through a rules-based approach, the BNP Paribas Technology Balanced 7 Index aims to create value by capturing the potential upside appreciation of the Nasdaq-100 Index® while seeking to substantially reduce the volatility of returns by employing a strategic risk reduction mechanism.

DOWNLOAD MATERIAL

Want to know more about the

BNP Paribas Technology Balanced 7 Index?

© BNP Paribas. All rights reserved.