Index Performance

The charts and tables below show the levels of the Nasdaq Night Owl Index.

The performance shown is hypothetically simulated until 20th Sep 2024

For more information, please consult our INDX related page.

Index overview & statistics – Hypothetical & Historical exposure as of .

| Bloomberg ticker | NIGHTOWL Index |

| Calculation Agent | BNP Paribas Financial Markets |

| Index Sponsor | BNP Paribas |

| Index Start Date | 31st Dec 2002 |

| Index Launch Date | 20th Sep 2024 |

| Index Type | Excess Return* |

| Weighting | Daily rebalancing |

| YTD | 1 Year | 3 Years | 5 Years | 10 Years | Global | |

| Annualized Return | ||||||

| Annualized Volatility | ||||||

| Annualized Return / Annualized Volatility |

Source: Bloomberg, BNP Paribas from 31st December 2002 to .. All numbers and figures are annualized (except for year-to-date).

Index Performance – Hypothetical & Historical exposure as of .

Annual Index Returns – As of .

| JAN | FEB | MAR | APR | MAY | JUN | JUL | AUG | SEP | OCT | NOV | DEC | Annual Return |

|---|

Source: Bloomberg, BNP Paribas from 31st December 2002 to .. All numbers and figures are annualized (except for current year).

*The Nasdaq Night Owl Index is an “Excess Return Index” meaning its returns are derived from changes in the level of its components (known as “price return”) and profit or loss gained from rolling from one futures contract to another (known as “roll return”). Unlike Total Return Indices, it does not derive returns based on interest earned on cash or other collateral deposited in connection with the purchase of futures contracts (known as “collateral return”).

COMPOSITION

The charts and tables below show the levels of the Nasdaq Night Owl Index.

The performance shown is hypothetically simulated until the launch date.

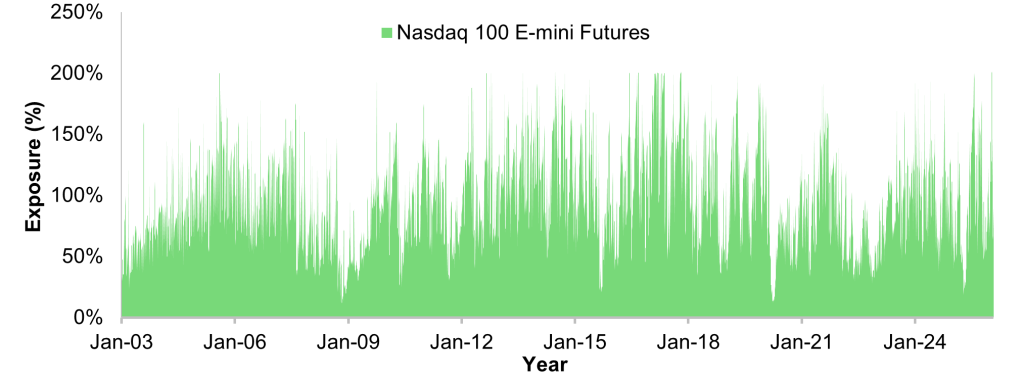

Hypothetical & Historical Exposure – As of 30th January 2026

Current Exposure – As of 30th January 2026: 58%

Source: Bloomberg, BNP Paribas from 31st December 2002 to .. Past performance is not an indicator of future performance. The Nasdaq Night Owl Index <NIGHTOWL Index> is based on Hypothetical Past Performance Data (”PPD”) prior to the Index Launch Date on 20th Sep 2024, actual/historical performance begins after Launch Date. Because the Nasdaq Night Owl Index did not exist prior to the Launch Date, all retrospective levels provided in the graph and table above are simulated and must be considered illustrative only. The presentation of hypothetical data reflects the deduction of fees and charges. These simulations are the result of estimates made by BNP Paribas at a given moment on the basis of the parameters selected by BNP Paribas, certain assumptions that may or may not hold in future periods, of market conditions at this given moment and of historical data, which should not be used as guidance, in any way, of the future results of the Nasdaq Night Owl Index.

RISK WARNINGS FOR HYPOTHETICAL PERFORMANCE DATA

This discussion is not and should not be construed to be investment advice or an offer to sell or purchase or solicitation of an offer to sell or purchase any security or other instrument.

This document describes strategies that may or may not be suitable or appropriate for particular investors and any investor is urged to consult with its investment, tax, accounting and other advisers prior to investing. Neither BNP Paribas nor any of its affiliates make any recommendation as to the suitability of any strategy or index for investment.

Selected Risk Consideration related to the Index:

- The methodology underlying the Index may not be successful — No assurance can be given that the strategy or objectives of the Index will be achieved.

- Numerous factors (including, but not limited to, changes in: interest rates, investor expectations, economic results, regulations, liquidity) may affect the components of the Index and the performance of the Index.

- The Index involves synthetic execution and may not reflect actual market activity.

- The Index may contain embedded fees, which will reduce performance. Fees are determined based on certain assumptions and may not reflect actual market activity. The amount of fees deducted may vary under different market conditions.

- The methodology and rules related to the Index is subject to change.

- The Index has limited historical information and publicly available information on the Index is limited. Additional information available upon request.

- Volatility control mechanism may limit performance.

- Rebalancing may result in concentration risk and/or be partially or completely uninvested and may not achieve performance.

- The use of leverage will have increased exposure to the index components.

Selected Risk Considerations related to the Hypothetical Performance:

Future performance may be worse than past and hypothetical historical results. Certain levels are simulated and must be considered hypothetical and illustrative only. Actual performance may bear little relation to the hypothetical historical results.

Hypothetical past performance is based on criteria applied retroactively with the benefit of hindsight and knowledge of factors that may have positively affected its performance, and cannot account for all financial risk that may affect the actual performance of the Index.

Hypothetical past performance might not reflect all possible market conditions. The Index may perform differently under other market conditions.

Little information is available publicly about the Index. Additional information regarding the methodology and rules related to the Index are available upon request.