NASDAQ NIGHT OWL INDEX

The Nasdaq Night Owl Index (“the Index”) is a rules-based index that aims to extract the overnight return, or “night effect”, of the Nasdaq-100 Index®. It targets an annual realized volatility of 15% by leveraging a risk mitigation strategy from BNP Paribas and a reactive risk control mechanism powered by Salt Financial.

The night effect is a well-known phenomenon whereby overnight markets have historically outperformed the daytime trading session on a risk-adjusted basis.

For an explanation of how the night effect works, please click here.

For a list of selected risks and considerations with the Nasdaq Night Owl Index, click here.

THE NASDAQ NIGHT OWL INDEX IS DESIGNED AROUND 3 KEY FEATURES

The Index has been designed to benefit from the night effect, a well-researched phenomenon1 that suggests overnight markets have historically outperformed the daytime trading session on a risk-adjusted basis. The methodology controls for costs and only rebalances to isolate the night effect when deemed to be most advantageous:

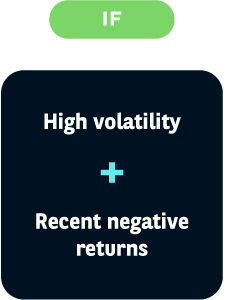

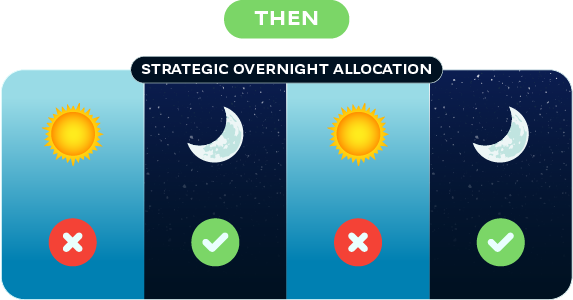

- If volatility is high2 and recent overnight returns have been negative3, then the Index triggers the strategic overnight allocation.

- Otherwise, the Index maintains equity exposure throughout both day & overnight sessions.

1 Bondarenko, Oleg, and Dmitriy Muravyev. “Market Return Around the Clock: A Puzzle.” Journal of Financial and Quantitative Analysis 58, no. 3 (2023): 939–67. Turc, Julien and Gava Jérôme and McNeal, Roxton. “The Early Bird Catches the Intraday Trend.” The Journal of Investing 31, no. 1 (2021): 47-75.

2 VIX is greater than 5% over its trailing monthly average.

3 Average trailing 5-day overnight return is negative.

4 A residual exposure to the Nasdaq-100 Index may remain during certain circumstances, subject to the vol control methodology or rebalancing constraints. BNP Paribas, for illustrative purposes only.

The Nasdaq Night Owl Index is solely comprised of equities, providing dynamic exposure to futures linked to one of the world’s preeminent large-cap growth indexes, the Nasdaq-100 Index®.

The Nasdaq-100 Index® defines today’s modern-day industrials, comprised of 100 of the largest and most innovative non-financial companies listed on the Nasdaq Stock Market based on market capitalization.

It includes growth-oriented industries such as:

Powered by Salt Financial’s truVol® Risk Control Engine and BNP Paribas’ Defensive Futures Overlay, the Index targets an annual realized volatility of 15%.

Salt Financial’s truVol® Risk Control Engine

Unlike traditional methodologies that only consider closing prices, truVol® captures more granular price data throughout each trading day and can react to market moves same-day. This allows it to respond faster to market events and deliver more accurate forecasts.

BNP Paribas’ Defensive Futures Overlay

This overlay employs BNP Paribas’ intraday short hedge strategy, designed to dynamically respond to significant market moves throughout the trading day.

For more information, please click here.

Harness the night effect with the Nasdaq Night Owl Index, the Index

that works day and night to generate enhanced Nasdaq returns.

Want to know more about the

Nasdaq Night Owl Index? Contact us at:

© BNP Paribas. All rights reserved.