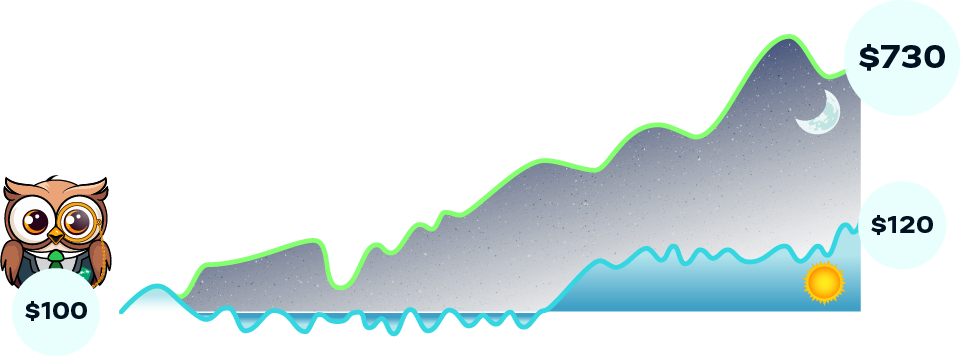

Historical data from the last 20 years have revealed an intriguing insight to Owlfred: if he had used 100 dollars to buy stocks at the market open and sell at the market close each day, his original investment would have grown to 120 dollars after 20 years.

Conversely, if he had instead used the same 100 dollars to invest only in the night session, buying stocks at the market close and selling at the following open, his investment would have grown to an impressive 730 dollars over the same period.

Source: BNP Paribas, Salt Financial, from 31st December 2002 to 29th December 2023. Investment represented by time-weighted average price of Nasdaq-100 Index® futures contracts and excluding any transaction costs. For illustrative purposes only.

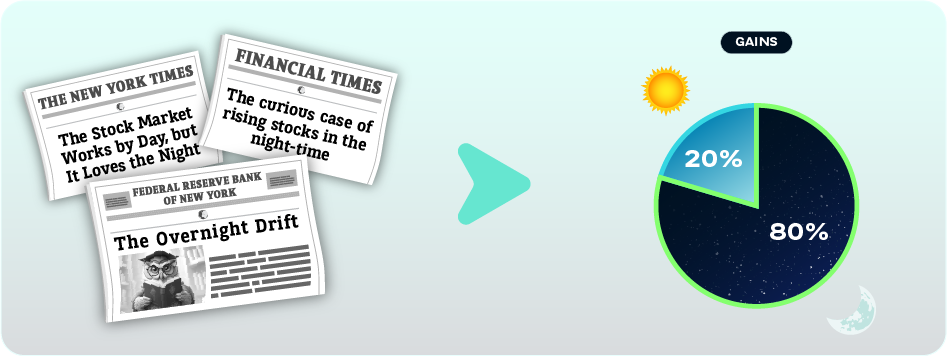

Recognizing the significance of this finding, Owlfred made a plan to seize upon this night effect as a promising avenue in pursuit of long-term profits. His confidence grew as he dove into academic literature* examining how market returns fluctuate around the clock.

What caught Owlfred’s attention was the consistent finding that the stock market’s night session tends to contribute most of the returns, while the day session adds a lot of risk, or “volatility”, for very little return. He realized that only 20% of his portfolio’s gains had come from the day session, while the night session actually accounted for 80%!

Together BNP Paribas, Salt Financial and Nasdaq refined Owlfred’s overnight concept and launched the Nasdaq Night Owl Index.

*Bondarenko, Oleg, and Dmitriy Muravyev. “Market Return Around the Clock: A Puzzle.” Journal of Financial and Quantitative Analysis 58, no. 3 (2023): 939–67. Turc, Julien and Gava Jérôme and McNeal, Roxton. “The Early Bird Catches the Intraday Trend.” The Journal of Investing 31, no. 1 (2021): 47-75