THE BNP PARIBAS MULTI-ASSET GLOBAL DIVERSIFIED INDEX

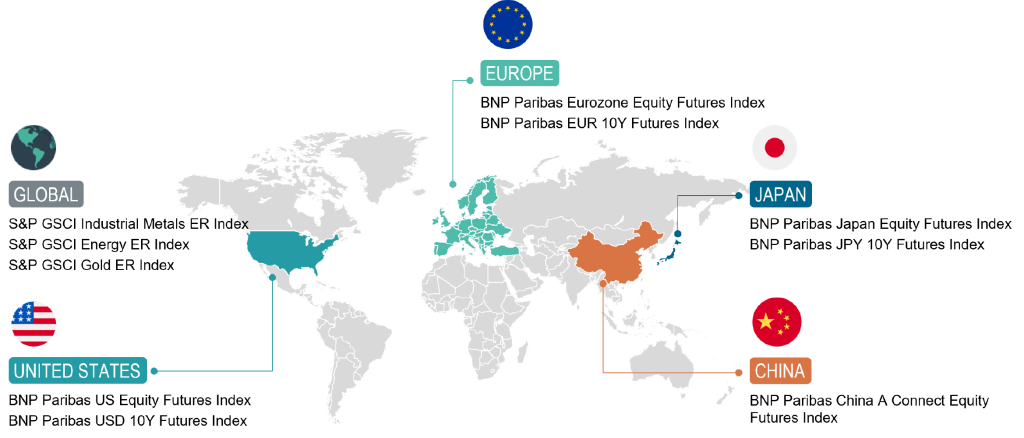

The BNP Paribas Multi-Asset Global Diversified Index (“the Index”) is a rules-based Index sponsored by BNP Paribas that provides exposure to a diverse range of asset classes and geographic regions, aiming to offer high returns with low volatility.

The Index is exposed to government bond futures and equity futures in Europe, the United States, China and Japan, as well as global commodities and commodity futures. It features a daily and dynamic asset allocation system, which dynamically rebalances the weightings of its components on a daily basis, as well as a daily volatility control mechanism, which targets an annualised realised volatility of 5%, also on a daily basis.

For a list of selected risks and considerations with the BNP Paribas Multi-Asset Global Diversified Index , please click here.

Click on the video below to learn more about the BNP Paribas Multi-Asset Global Diversified Index

HIGHER RETURNS & LOWER VOLATILITY DUE TO

Selected based on the following principles:

The Index dynamically rebalances the weightings of the components according to a proprietary rule-based methodology using trend following.

This process follows three steps:

Universe creation

The allocation process begins by creating a universe of potential portfolios where the components are differently weighted across the board and under weight constraints.

Universe creation

The allocation process begins by creating a universe of potential portfolios where the components are differently weighted across the board and under weight constraints.

Universe creation

The allocation process begins by creating a universe of potential portfolios where the components are differently weighted across the board and under weight constraints.

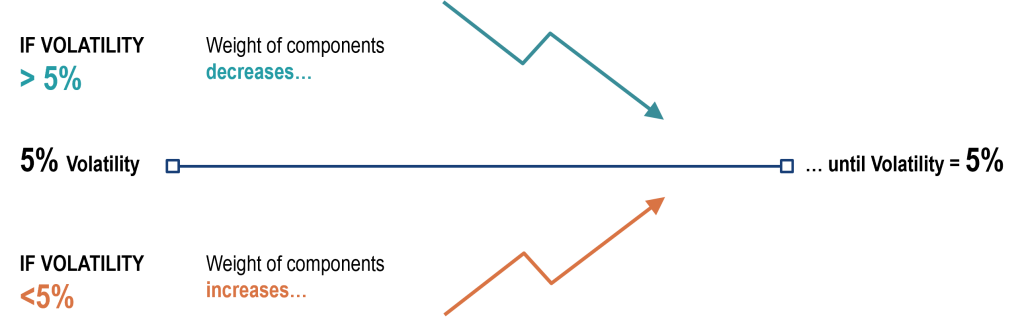

On a daily basis, the Index targets a Realised Volatility of around 5%, through a volatility control mechanism implemented during the Portfolio Construction..

If the Realised Volatility exceeds the Target Volatility of 5%, the weight of each Index Component is reduced proportionately.

If the Realised Volatility is below the Target Volatility, the weight of each Index Component is increased proportionately

Wish to know more about the

BNP Paribas Multi-Asset Global Diversified Index?

© BNP Paribas. All rights reserved.