THE BNP PARIBAS MULTI ASSET DIVERSIFIED 5 AUD HEDGED INDEX

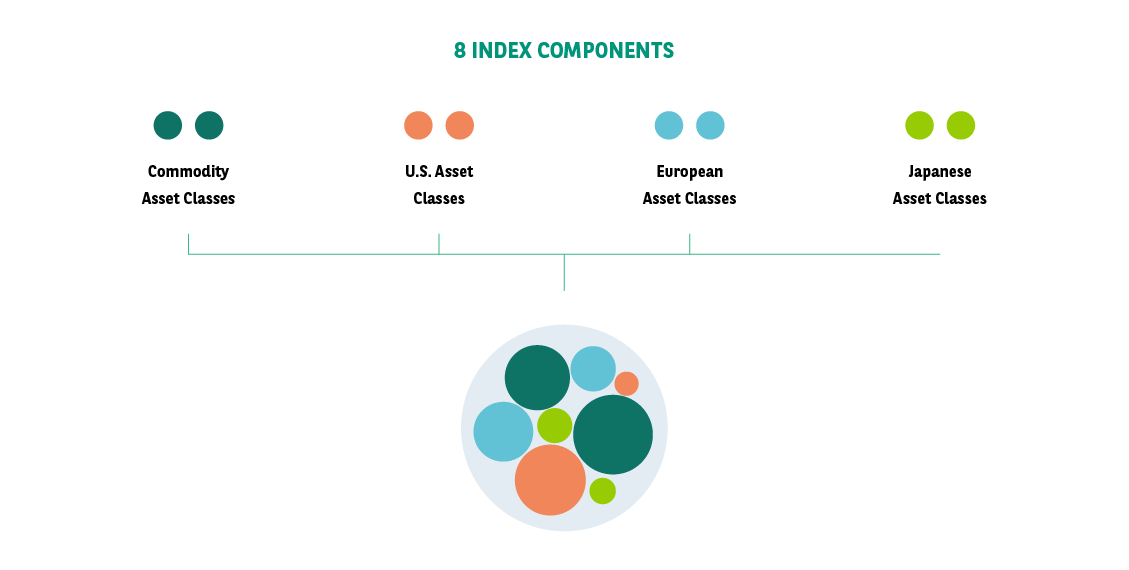

The BNP Paribas Multi Asset Diversified 5 AUD Hedged Index (“BNPP MAD 5 AUD Index”) is a rules-based index sponsored by BNP Paribas comprised of eight components – three equity futures indices, three bond futures indices and two commodity indices across a number of geographic regions (the “Hypothetical Portfolio”).

The index dynamically rebalances the weights of its components, using a methodology based on momentum investing principles, which seeks to identify weights for the components that would have resulted in the hypothetical portfolio with the highest return subject to a certain level of volatility. In addition, the BNPP MAD 5 AUD Index includes a risk control mechanism which seeks maintain its short-term volatility at the 5% level, and to reduce volatility during unstable and unpredictable market periods.

For a list of selected risk and considerations with the BNPP MAD 5 AUD Index, please click here.

The BNPP MAD 5 AUD Index is the AUD-hedged version of the original BNP Paribas Multi Asset Diversified 5 Index, denominated in USD. For more information on the USD version click here.

THE BNP PARIBAS MULTI ASSET DIVERSIFIED 5 AUD HEDGED INDEX INCLUDES

The eight components are liquid market benchmarks that cover diverse geographic zones and a range of generally non-correlated assets including equities, commodities and government bond futures.

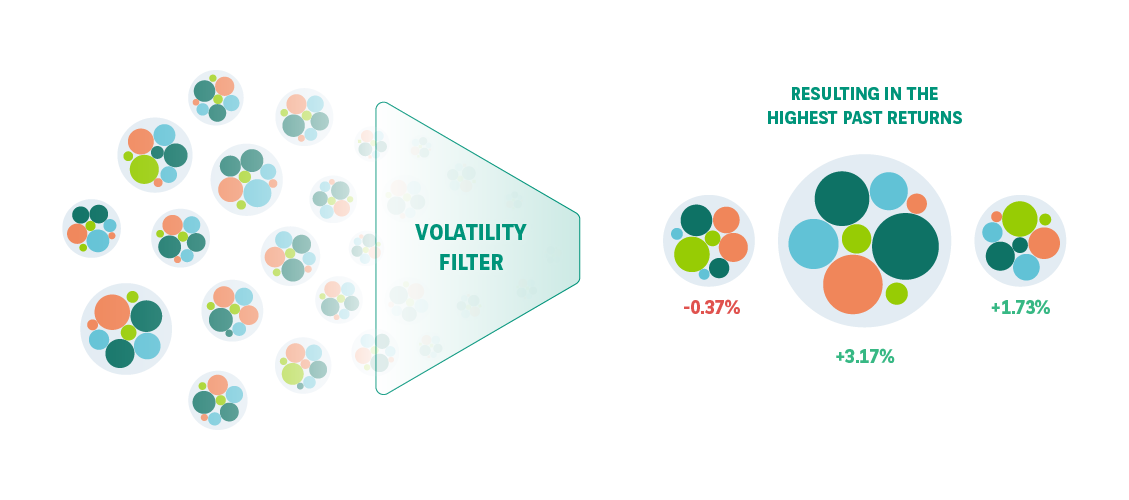

On a daily basis, the Index dynamically rebalances the weights of its components according to a proprietary rules-based methodology which seeks to identify weights for the components that would have resulted in the Hypothetical Portfolio with the highest past returns1, subject to a certain level of volatility and weighting constraints2.

1Computed based on a trend indicator that compares current component level to past component level over a 1 year period

2The components maximum weights are as follows: Each Equity Futures Index 25%, each Bond Futures Index 50%, and each Commodity Index 25%. Leverage is allowed and the cost of borrowing is zero. The sum of all weights is capped at 200% and floored at 0%. Minimum weight is 0% for each component. On a daily basis the absolute change in weight for each component cannot be greater than 5%.

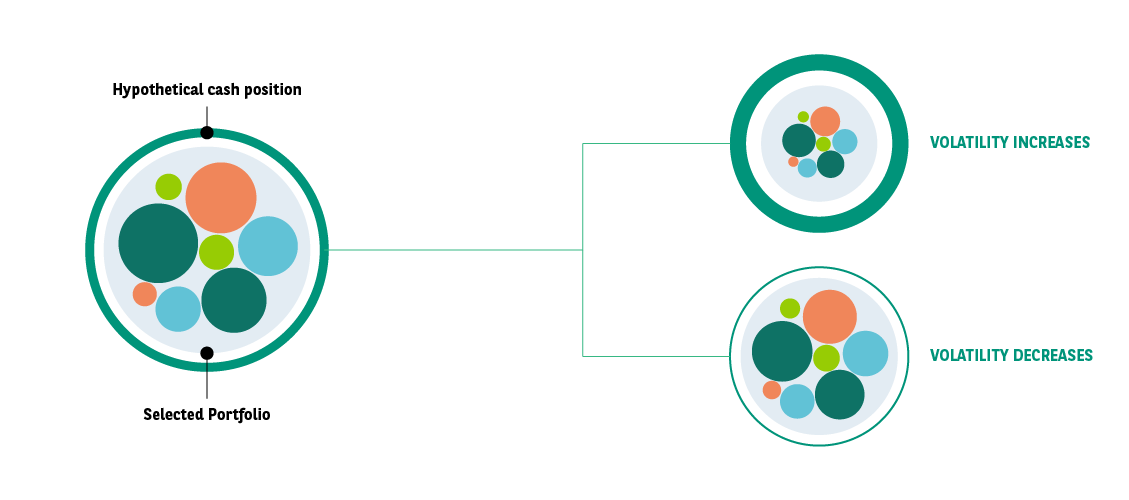

Daily, the Hypothetical Portfolio targets an annualized realized volatility of 5%. If the realized volatility exceeds the 5% target rate on any day, the Index will reduce the weight of the portfolio and rebalance it with a non-remunerable hypothetical cash position. Based on the realized volatility, the BNPP MAD 5 AUD Index may be partially or wholly uninvested, and will not earn interest or any other return with respect to that cash position.

Download Material

Brochure

An 8 page overview of the Index complete with performance information and definitions of key terms. Updated quarterly.

Factsheet

A more concise overview of the Index, complete with latest performance information. Updated quarterly.