THE BNP PARIBAS MULTI ASSET DIVERSIFIED 10 AUD HEDGED INDEX

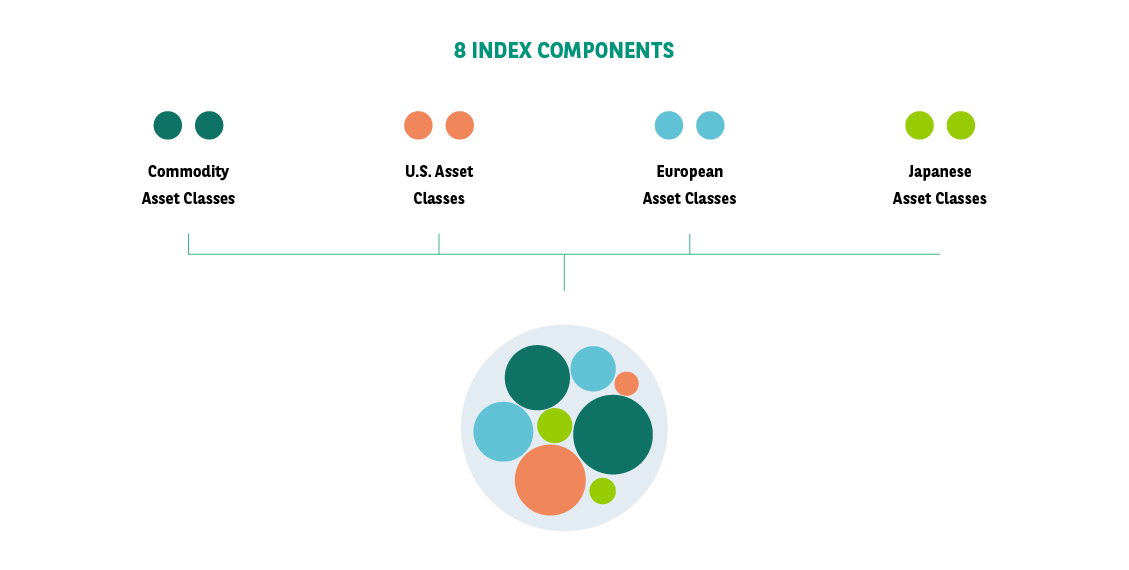

The BNP Paribas Multi Asset Diversified 10 AUD Hedged Index (“BNPP MAD 10 AUD Index”) is a rules-based index sponsored by BNP Paribas comprised of eight components – three equity futures indices, three bond futures indices and two commodity indices across a number of geographic regions (the “Hypothetical Portfolio”).

The index dynamically rebalances the weights of its components, using a rules-based methodology based on momentum investing principles, which seeks to identify weights for the components that would have resulted in the hypothetical portfolio with the highest return subject to a certain level of volatility. In addition, the BNPP MAD 10 AUD Index includes a risk control mechanism which seeks maintain its short-term volatility at the 10% level, and to reduce volatility during unstable and unpredictable market periods.

For a list of selected risk and considerations with the BNPP MAD 10 AUD Index, please click here.

The BNPP MAD 10 AUD Index is the AUD-hedged version of the original BNP Paribas Multi Asset Diversified Index, denominated in USD. For more information on the USD version click here.

THE BNP PARIBAS MULTI ASSET DIVERSIFIED 10 AUD HEDGED INDEX INCLUDES

The eight components are liquid market benchmarks that cover diverse geographic zones and a range of generally non-correlated assets including equities, commodities and government bond futures.

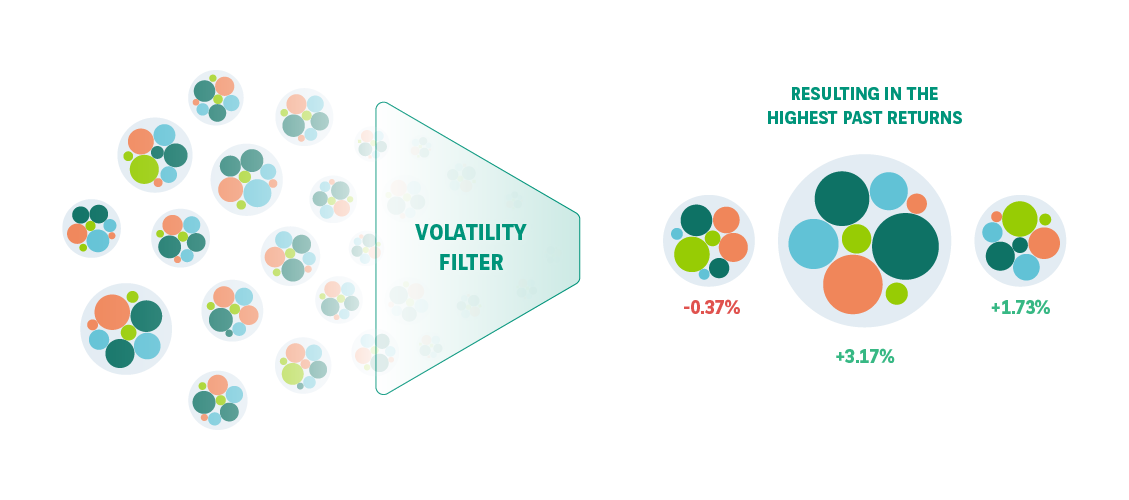

On a daily basis, the Index dynamically rebalances the weights of its components according to a proprietary rules-based methodology which seeks to identify weights for the components that would have resulted in the Hypothetical Portfolio with the highest past returns1, subject to a certain level of volatility and weighting constraints2.

1Computed based on a trend indicator that compares current component level to past component level over a 1 year period

2The components’ maximum weights are as follows: each Equity Futures Index 50%, each Bond Futures Index 100%, and each Commodity Index 50%. Leverage is allowed and the cost of borrowing is zero. The sum of all weights is capped at 400% and floored at 0%. Minimum weight is 0% for each component. On a daily basis the absolute change in weight for each component cannot be greater than 10%.

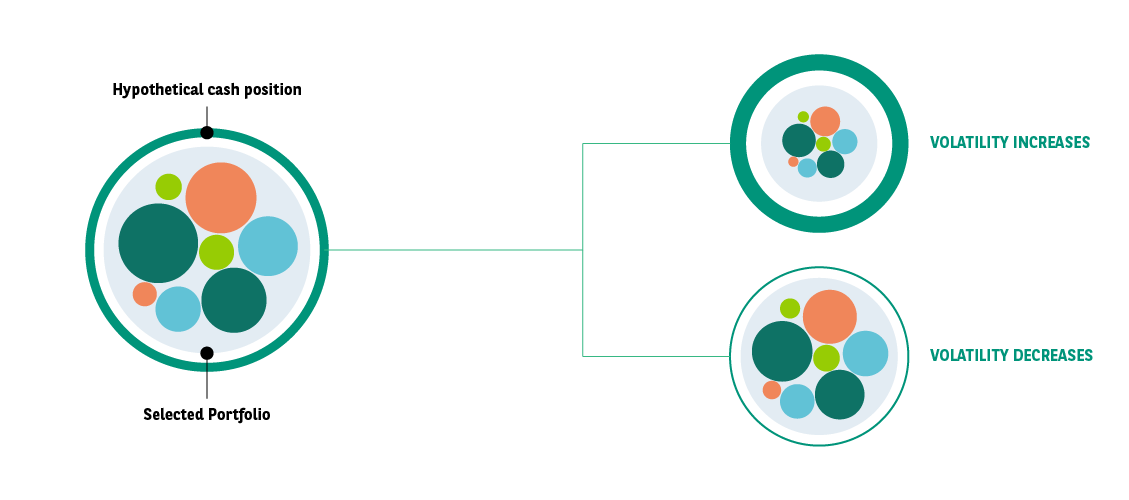

Daily, the Hypothetical Portfolio targets an annualised realised volatility of 10%. If the realised volatility exceeds the 10% target rate on any day, the Index will reduce the weight of the portfolio and rebalance it with a non-remunerable hypothetical cash position. Based on the realised volatility, the BNPP MAD 10 AUD Index may be partially or wholly uninvested, and will not earn interest or any other return with respect to that cash position.

For Illustrative Purpose Only

Download Material

Brochure

An 8 page overview of the Index complete with performance information and definitions of key terms. Updated quarterly.

Factsheet

A more concise overview of the Index, complete with latest performance information. Updated quarterly.