The US Innovative Leaders 5 Index is a rules-based index aiming to generate positive returns by providing exposure to 50 stocks of leading companies that are positioned at the forefront of innovation by investing extensively in technology.

Companies investing in innovative fields have the potential to disrupt the market by introducing and developing new and enhanced products, concepts and services. The US Innovative Leaders 5 Index seeks exposure to companies that are market leaders and are investing in one of the six key themes below, as they may be well positioned to potentially outperform their competitors through innovation. The themes were selected because they have potentially higher growth prospects and could significantly impact the market.

- Data Computing

& Processing - Artificial

Intelligence - Automotive

Innovation - Internet

of Things - Robotics

- Healthcare

Innovation

Data Computing & Processing entails manipulating large amounts of raw data into ready-to-use information for the intended user, such as companies or individuals. The automatic processing and computing of data allows for faster and more efficient planning.

Artificial Intelligence (AI) is the culmination of efforts to teach computers how to think and learn. It has the potential to unlock productivity gains that can change the way in which technology is used.

Automotive Innovation aims to reinvent the automobile industry by designing sustainable vehicles, complying with new regulations and exceeding customer needs. To achieve this, technologies such as automation, connectivity and electric power are used.

Internet of Things represents the interconnectedness of devices, machines and objects, facilitating communication without human interaction. Such connections can encourage automation and control of tasks and activities.

Robotics technology designs and constructs robots. Robots and the computer that controls them, are developed for the purpose of replicating humans in processes in different fields, including engineering and business.

Healthcare Innovation should improve the effectiveness and quality of healthcare by adopting new or improved products, practices or systems, in order to meet public healthcare needs.

In addition, the Index implements a risk control mechanism to potentially reduce volatility and the magnitude of drawdowns during market corrections. The Index aims to maintain the annualized volatility level around 5% by increasing or decreasing exposure to the components or a hypothetical cash position1.

1 The Index creates a blended portfolio with equities and 10-Year US Treasuries to reach the 5% volatility target. When equity markets are volatile, the Index decreases exposure to the selection of stocks and increases exposure to 10-Year US Treasuries. When volatility of all components exceeds the target exposure of 5%, overall exposure is reduced by allocating a pro-rata portion to a hypothetical cash position. When volatility is low, overall exposure may be increased up to 150%. Based on the realized volatility, the US Innovative Leaders 5 Index may be partially or wholly uninvested, and will not earn interest or any other return with respect to that cash position.

Click on the video to learn more about the US Innovative Leaders 5 Index.

Innovative Stock Selection

The US Innovative Leaders 5 Index follows a rules-based methodology aiming to generate positive returns by selecting 50 US companies that are leaders in the innovation space.2 This stock selection aims to generate outperformance compared to a traditional market benchmark, such as the S&P 500. The methodology is applied on a quarterly basis to reflect changing levels of innovativeness, based on the number of patents a company holds.

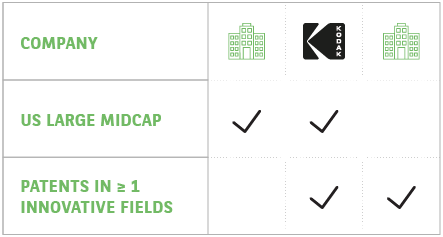

The Index is only focused on US Large Midcaps as large companies can have a greater potential to disrupt the market they are in, generally experience less volatility and also tend to be more liquid.

2 Data provided by Nasdaq.

- Select Innovative

US Large Midcaps - Select the most

Innovative Companies - Select the Top 50

Innovative Companies

First, the Index only selects US Large Midcaps investing in innovation by holding at least one patent in 1 of the 25 innovative fields.

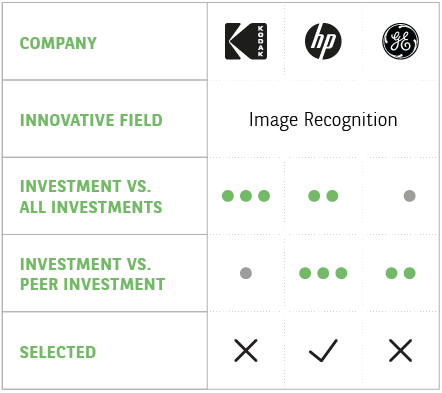

Secondly, from the US Large Midcaps mapped, the Index selects companies investing extensively in innovative activities. To determine the amount of investments in innovation, the number of patents is used as a proxy.

![]() How much a company invests in innovative fields vs. all their investments.1

How much a company invests in innovative fields vs. all their investments.1

![]() How much a company invests in innovative fields vs. their peers.2

How much a company invests in innovative fields vs. their peers.2

Only the companies that rank in the top 50% in innovation investment compared with both their total investments and their peers, are selected.

2 Determined by the contribution score – ratio between the number of patents a company holds in an innovative field and the total number of patents in that innovative field.

1 Determined by the pure score – ratio of the number of patents a company holds in an innovative field and the total number of patents the company holds.

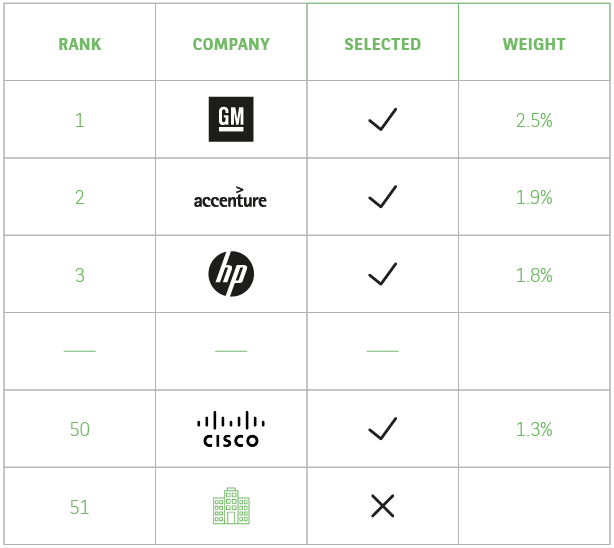

Finally, the Index ranks the companies and selects the 50 companies that have the highest intensity of investment in the innovative fields.3

Based on the investment intensity ranking, the companies are assigned a weight, where the highest ranking companies are assigned more weight and vice versa.

3 The investment intensity is determined by the intensity score, which counts the number of times in which companies have both pure and contribution scores above 25%.

Download Material

Brochure

An 8 page overview of the Index complete with performance information and definitions of key terms. Updated monthly.

FACTSHEET

A more concise overview of the Index, complete with latest performance information. Updated monthly.