BNP PARIBAS US GOVERNANCE MULTI ASSET INDEX

The BNP Paribas US Governance Multi Asset Index (“the Index”) is a rules-based Index, comprised of seven components – one equity index, three treasury futures indices and three commodity indices (the “Selected Portfolio”), aiming to source ethical outperformance while benefiting from a diversified exposure through additional varied and international assets.

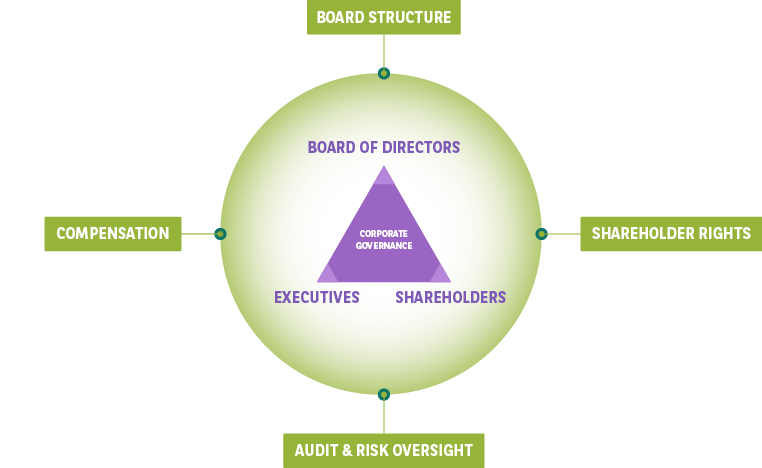

The Index uses data provided by ISS ESG1, the world’s leading provider of corporate governance data, to score and select US liquid companies according to four Governance criteria: Audit & Risk Oversight, Board Structure, Shareholder Rights and Compensation.

For a list of selected risk and considerations with the BNP Paribas US Governance Multi Asset Index, please click here

1All rights in the information provided by Institutional Shareholder Services Inc. and its Affiliates (“ISS”) reside with ISS and/or its licensors. ISS is not the producer of the BNP Paribas US Governance Multi Asset Index and ISS does not have any responsibilities, obligations or duties in the administration, management or marketing of said index. The BNP Paribas US Governance Multi Asset Index is not owned, sponsored, endorsed, or promoted by ISS. ISS makes no representation or warranty, express or implied, regarding the advisability of investing in products that are based on the BNP Paribas US Governance Multi Asset Index or otherwise relying on said index for any purpose. ISS shall have no liability to any third parties for any errors or omissions, inaccuracy, incompleteness, delay, or interruption in the BNP Paribas US Governance Multi Asset Index, any data related thereto, or any values thereof.

THE BNP PARIBAS US GOVERNANCE MULTI ASSET INDEX INCLUDES

Corporate Governance speaks to the relationship among the Board of Directors, Executives and Shareholders, and the ISS Governance QualityScore captures four Governance criteria that address these relationships and practices.

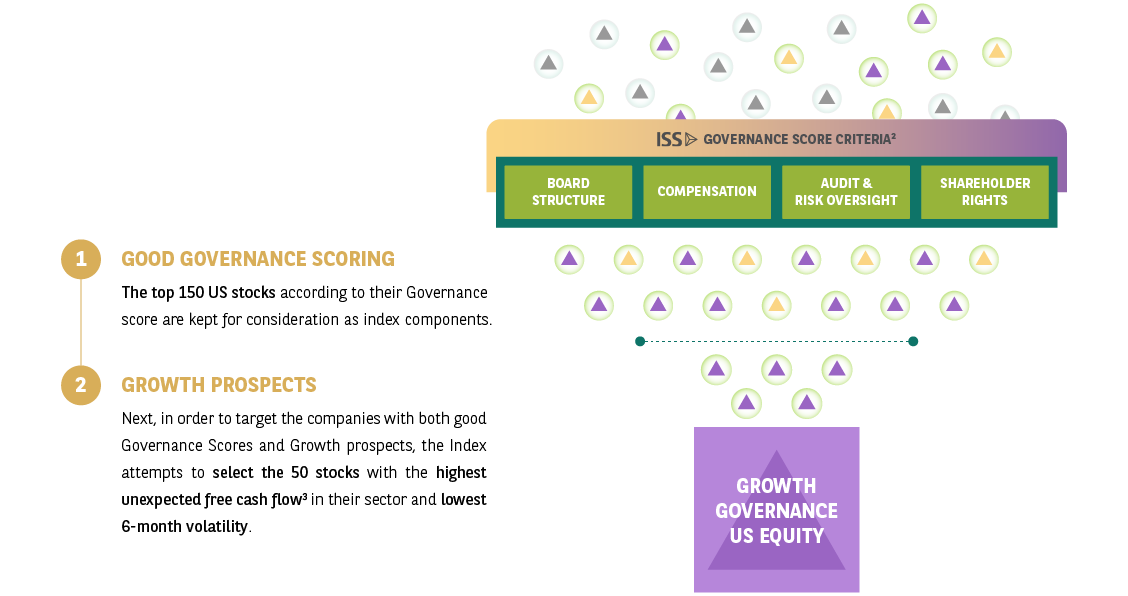

Every month, a score is given to a pool of liquid US stocks1 based on the four ISS Governance criteria: Audit & Risk Oversight, Board Structure, Shareholder Rights and Compensation, and then from there, growth-oriented stocks are identified.

For more information about the ISS Governance Qualityscore,

please visit https://www.issgovernance.com

1U.S. stocks must have a minimum of $10 million 20-day average daily trading value to be eligible.

2Governance Score: ISS ESG’s Governance QualityScore uses a numeric, decile-based score that indicates a company’s governance risk relative to their index or region. A score in the 1stdecile (QS=1) indicates relatively higher quality governance practices and relatively lower governance risk, and, conversely, a score in the 10th decile (QS=10) indicates relatively lower quality governance practices and relatively higher governance risk. For a stock to be included in the BNP Paribas Governance Multi Asset Index it must have: an ISS ESG Audit & Right Oversight raw score greater than or equal to 0, an ISS ESG Board Structure score below 7, an ISS ESG Shareholder Rights score below 7 and an ISS ESG Compensation score below 7.

3Unexpected Free Cash Flow is measured by each stock’s free cash flow increase year-on-year. For each sector, the 66% of stocks in the investment universe with the lowest increase in unexpected free cash flow are discarded. The remaining 33% are then ranked according to their 6-month volatility, and the 50 stocks with the lowest level are selected, creating the Equity component of the BNP Paribas Governance Multi Asset Index.

Diversification

In order to attempt maintaining a diversified range of exposures, in addition to the Equity component, the Index also includes international treasuries and commodities (forming the “Hypothetical Portfolio”).

Weighting of components

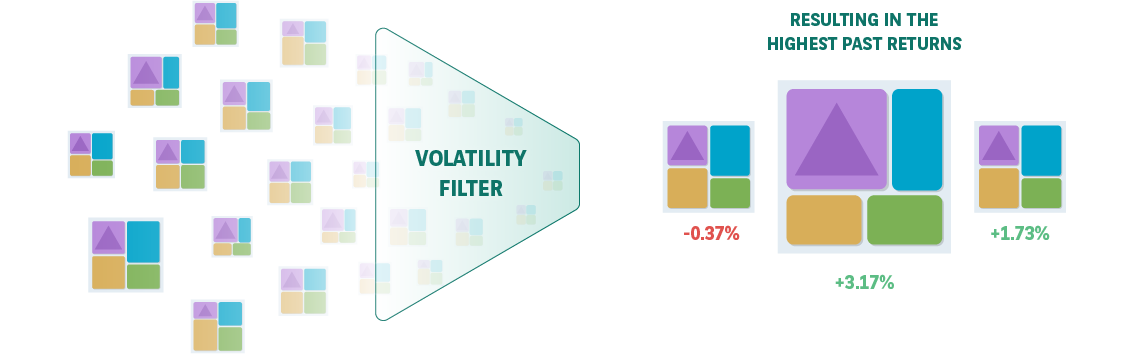

On a daily basis, the Index dynamically rebalances the weights of its components according to a proprietary rules-based methodology.

This methodology seeks to identify weights for the components that would have resulted in the Hypothetical Portfolio with the highest past returns1, subject to a certain level of volatility and weighting constraints2.

1Computed based on a trend indicator that compares current component level to past component level over a 1 year period.

2The components maximum weights are as follows: Growth Governance US Equity 75%, 10Y US Treasury Futures 75%, 10Y Europe Treasury Futures 25%, 10Y Japan Treasury Futures 25%, Gold 25%, Commodity ex-Agriculture and Livestock 25%. Leverage is allowed and the cost of borrowing is zero. The sum of all weights is capped at 200% and floored at 0%. Minimum weight is 0% for each component.

In addition to its multi asset components, the BNP Paribas US Governance Multi Asset Index seeks to leverage a commodity carry overlay1 with a fixed weight of 20% to attempt to capture additional outperformance and incorporates a 5% volatility control mechanism with the objective to achieve stable returns.

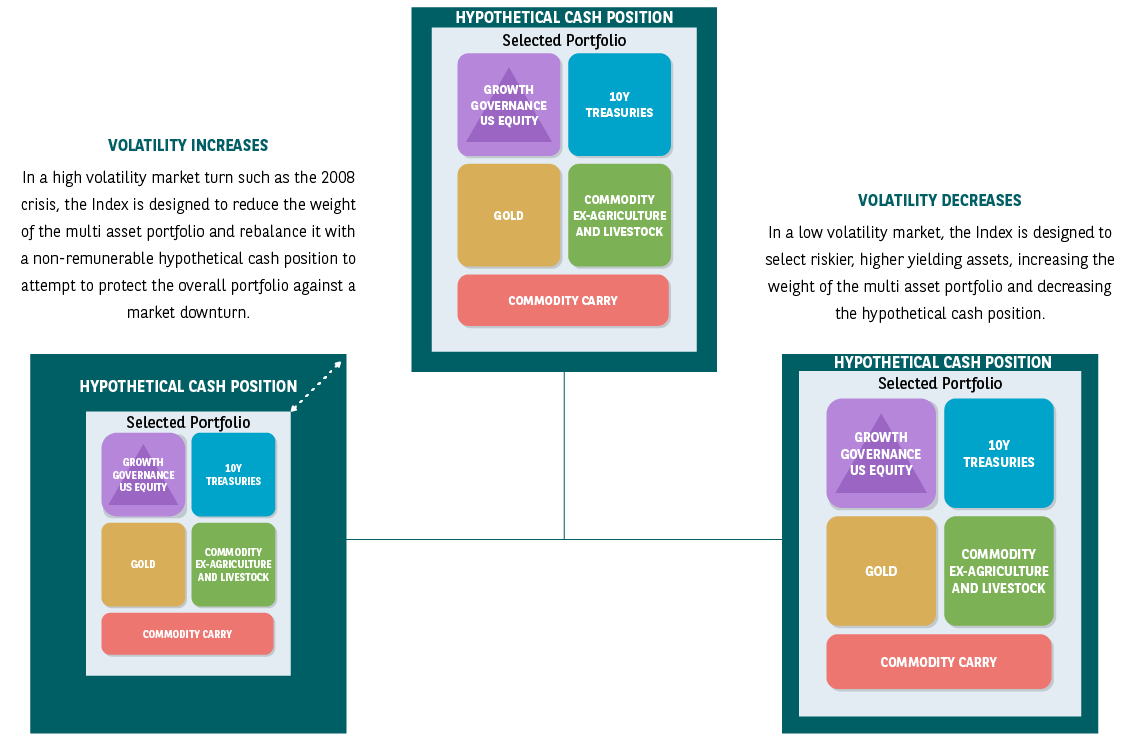

On a daily basis, the Index seeks to adjust its exposure among the stocks, treasury futures, commodities and a hypothetical cash position to target an annualized realized volatility of 5%.

For illustrative purposes only.

1Commodity Carry overlay is added in the form of a BNP Paribas Index that captures outperformance of maturity positioning commodity futures versus the front month of 10 mono-commodities (WTI, Brent, Heating Oil, Gasoline, Natural Gas, Gasoil, Aluminum, Zinc, Nickel, Copper).

DOWNLOAD MATERIAL

Want to know more about the

BNP Paribas US Governance Multi Asset Index?

© BNP Paribas. All rights reserved.