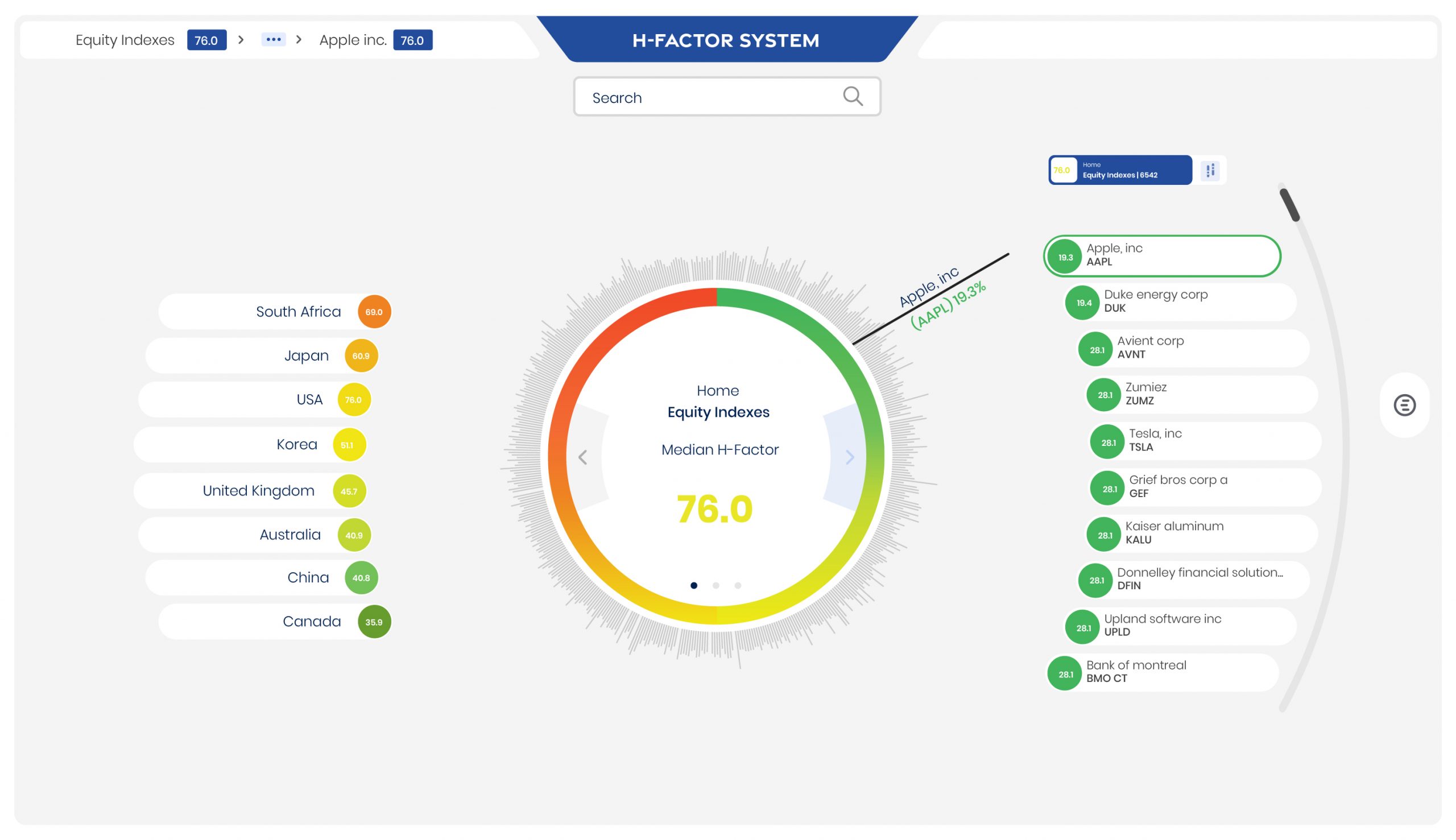

The H-Factor System:

New Age Alpha’s portfolio tool for identifying and avoiding a hidden risk that can erode returns

Asset management innovator New Age Alpha has developed an actuarial-based approach to mitigate human behavior’s impact on stock prices. New Age Alpha’s H-Factor methodology drives stock selection, using technology, actuarial science and 20 years’ research to score and seek avoidance of human behavior risk that it believes causes stocks to be mispriced.

The BNP Paribas Global H-Factor Index employs the New Age Alpha H-Factor system for the selection of the 225 global stocks that form the equity portion of the index.

WHAT IS THE H-FACTOR?

Human behavior is a risk that comes from humans interpreting vague or ambiguous information in a systematically incorrect way.

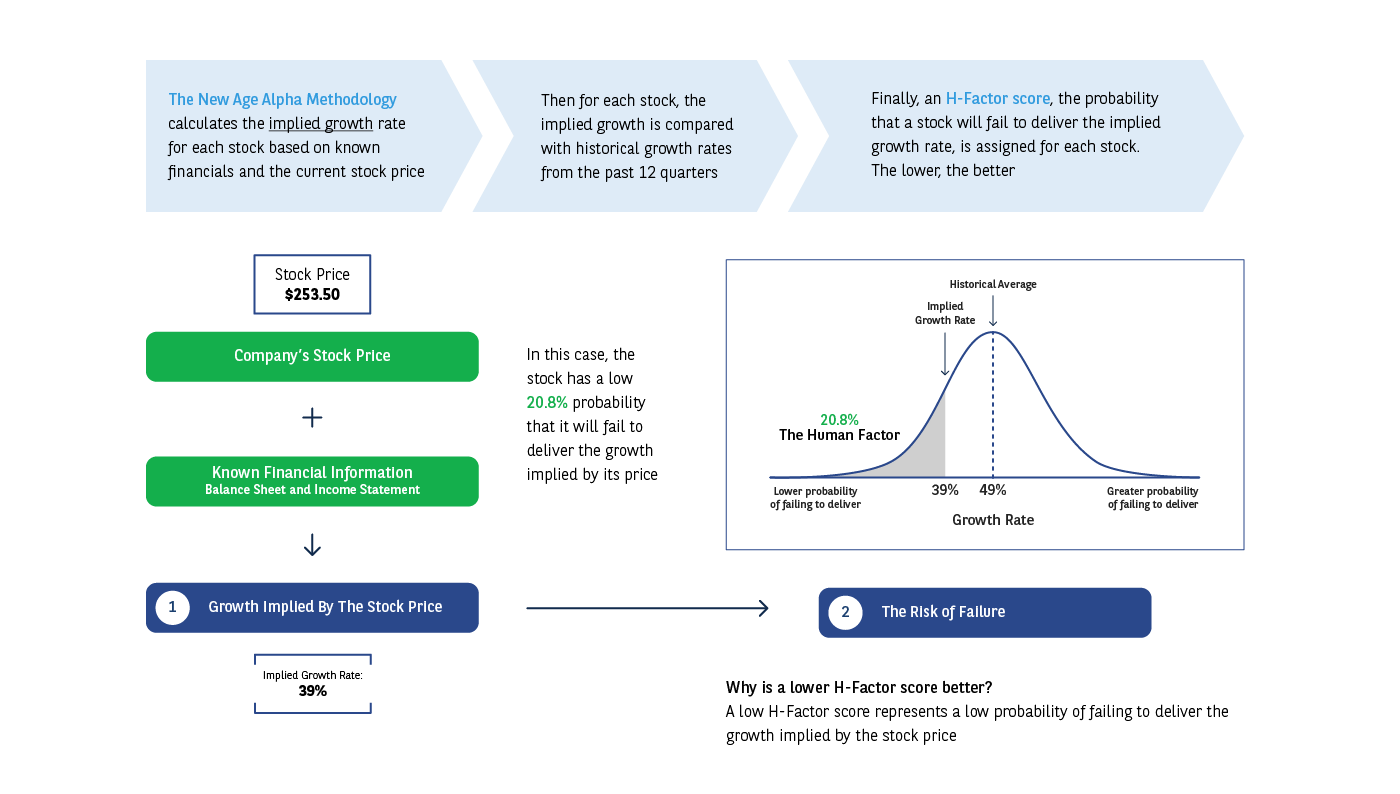

BEHIND THE H-FACTOR METHODOLOGY

Hypothetical depiction for illustrative purposes only.

For more information about New Age Alpha’s H-Factor

System methodology, please visit their website:

ABOUT NEW AGE ALPHA

New Age Alpha is a tech-driven asset management company that seeks to identify, measure and avoid companies whose securities are overpriced. The experienced team includes founders with successful 20-year partnership, investment and management team with 10 years’ experience working together and proven track record across asset classes and geographies. New Age Alpha provides ETFs, indexes, separately managed accounts, alternatives and custom portfolio solutions for global equities, fixed income and ESG.

Want to know more about the

BNP Paribas Global H-Factor Index?

© BNP Paribas. All rights reserved.