INTRODUCING THE

BNP PARIBAS GLOBAL H-FACTOR INDEX

BNP Paribas has collaborated with New Age Alpha, an asset management innovator which utilizes an actuarial-based approach to mitigate human behavior’s impact on stock price, to introduce the BNP Paribas Global H-Factor Index (“BNPP Global H-Factor Index”).

This rules-based index aims to provide a balance between growth potential and asset protection by seeking to systematically avoid human behavior risk, or the H-Factor. New Age Alpha’s H-Factor methodology drives stock selection, using technology, actuarial science and 20 years’ research to score and seek avoidance of human behavior risk that it believes causes stocks to be mispriced.

225 global stocks with the lowest Human Factor scores form the New Age Alpha Global Leading Index, the equity portion of the BNPP Global H-Factor index. In addition to equities, the BNPP Global H-Factor Index also utilizes exposure to US Treasury futures for diversification. On a daily basis, the Index methodology adjusts exposure among the stocks, Treasury futures, and a hypothetical cash position to maintain the index’s annualized volatility of 5%.

For a list of selected risk and considerations with the BNPP Global H-Factor Index, please click here

BNP PARIBAS GLOBAL H-FACTOR INDEX:

A PROBABILITY-BASED APPROACH

Click on the video to learn more about the BNP Paribas Global H-Factor Index

THE BNP PARIBAS GLOBAL H-FACTOR INDEX INCLUDES

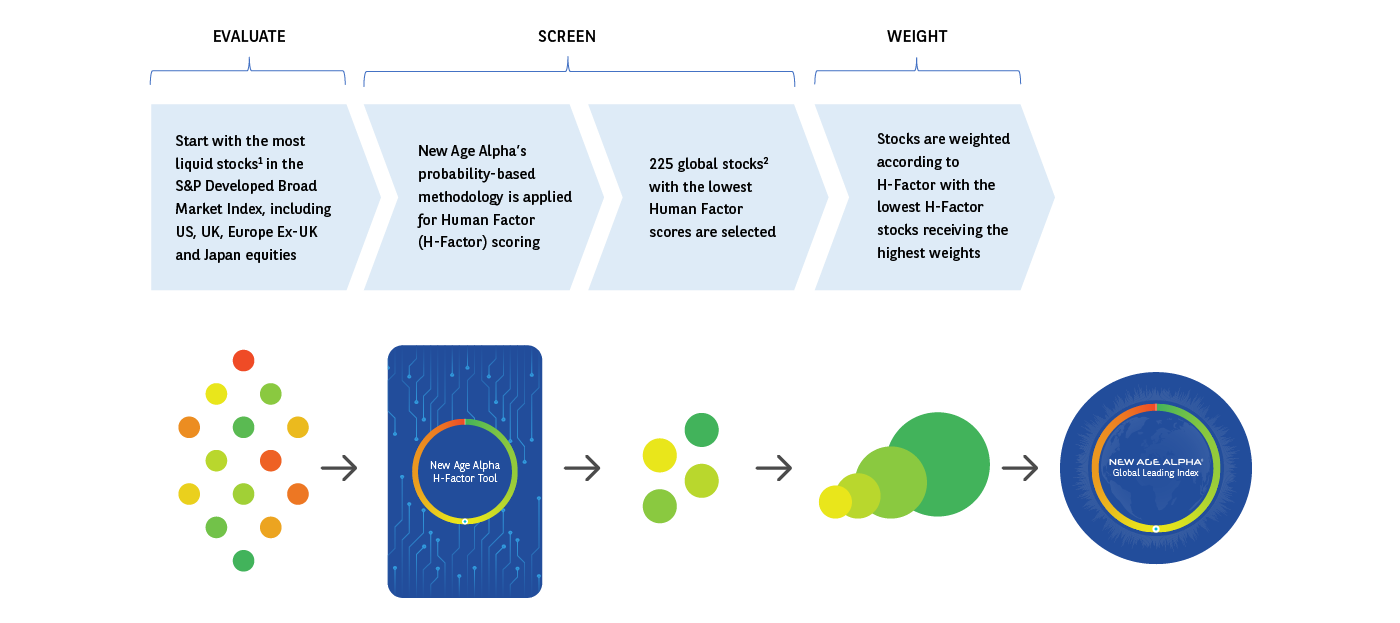

Each quarter, the index goes through a 3 step process to identify and refine its allocation of global stocks from a broad universe

EACH QUARTER:

For illustrative purposes only.

1U.S. stocks must have a minimum of $5 million 6- month average daily trading value and at least a $3 stock price to be eligible. Non-U.S. stocks must have a minimum $1 million 6-month average daily trading value and a minimum market-cap of $100 million.

250 from the U.S, 75 from Europe, 50 from UK, 50 from Japan.

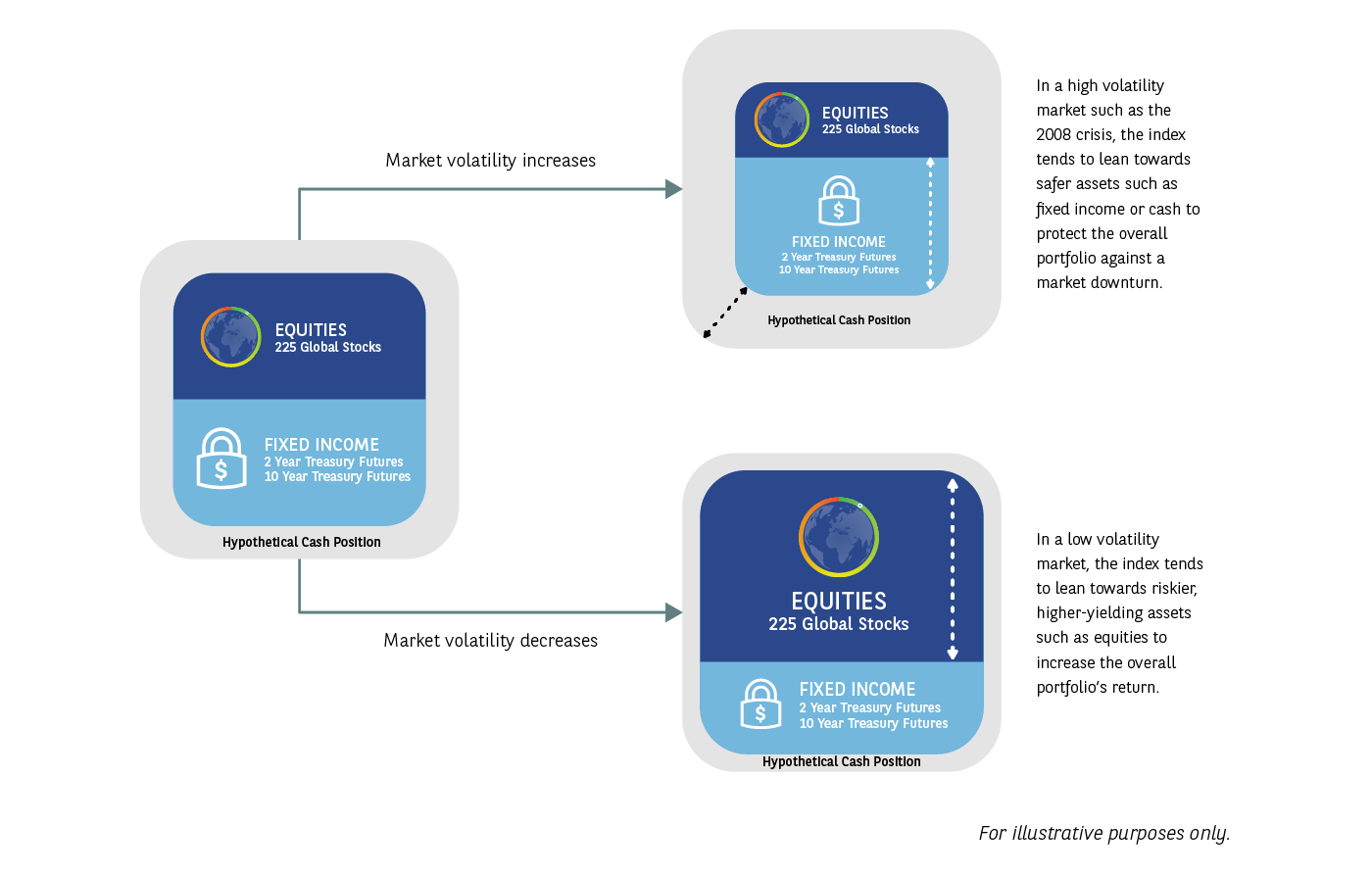

In an effort to hedge the portfolio in changing market conditions, a risk control mechanism is employed.

On a daily basis, the BNPP Global H-Factor Index adjusts its exposure among the stocks, Treasury futures, and a hypothetical cash position to target an annualized realized volatility of 5%.

to learn more about H-Factor methodology

DOWNLOAD MATERIAL

Want to know more about the

BNP Paribas Global H-Factor Index?

© BNP Paribas. All rights reserved.