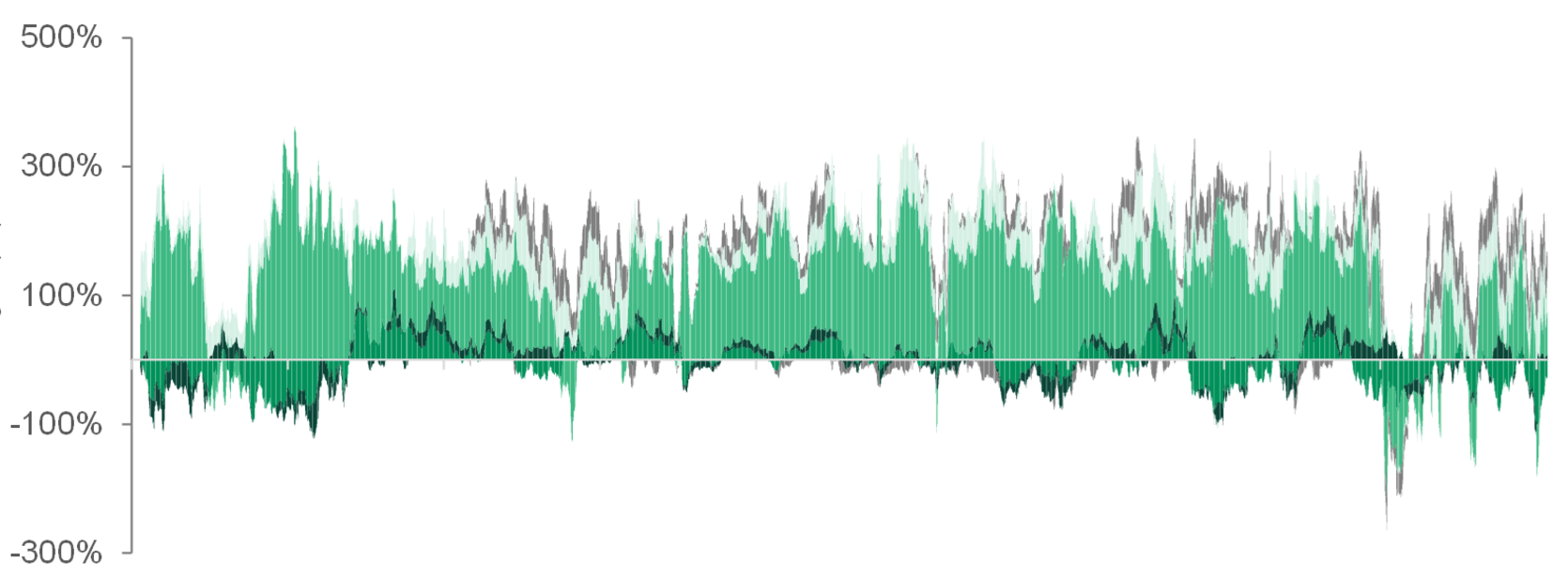

The charts and tables below show the levels of the BNP Paribas Multi-Asset Trend Index.

The performance shown is hypothetically simulated until January 11th, 2021.

| Bloomberg ticker | BNPITRND |

| Calculation Agent | BNP Paribas Arbitrage SNC |

| Index Sponsor | BNP Paribas |

| Index Type | Excess return(1) |

| Weighting | Daily rebalancing |

| Index Launch Date | January 11th, 2021 |

| Global | YTD | Last 1 Year | Last 3 Years | Last 5 Years | Last 10 Years | |

| Return | ||||||

| Volatility | ||||||

| Sharpe Ratio |

Source: Bloomberg, BNP Paribas from December 31st 1998 to . All numbers and figures are annualized.

Source: Bloomberg, BNP Paribas from December 31st 1998 to . All numbers and figures are annualized.

(1) The BNPP Multi-Asset Trend Index is an "Excess Return Index" meaning that the Index level reflects the performance of any underlying components that are in excess of 3-month USD LIBOR and inclusive of the value that would be derived from the reinvestment of any dividends and distributions by the issuer of any such components. See the Risks & Consideration page for additional Index disclosures.

The charts and tables below show the levels of the BNP Paribas Multi-Asset Trend Index.

The performance shown is hypothetically simulated until January 11th, 2021.

| Equities | Rates | Forex | Commodities | Credit | Total | |

| 3Y AVERAGE EXPOSURE | 35.6% | 44.6% | -24.7% | 5.6% | 29.2% | 90.27% |

The BNP Paribas Multi-Asset Trend Index (the “BNPP Multi-Asset Trend Index”) is the exclusive property of BNP Paribas or one of its affiliates (BNP Paribas and its affiliates are hereinafter called “BNPP”) and is determined, composed and calculated by BNPP. “BNP”, “BNPP”, “BNP Paribas”, “BNP Paribas Multi-Asset Trend Index”, and “BNPP Multi-Asset Trend Index” (collectively, the “BNPP Marks”) are trademarks or service marks of BNPP.

In calculating the performance of the BNPP Multi-Asset Trend Index, BNPP deducts an annual fee of 0.50% per annum, calculated on a daily basis which reduces the performance of the index in the same way as a cost. In addition, the BNPP Multi-Asset Trend Index methodology embeds certain costs which cover among other things, rebalancing and replication costs. Such costs (if any) may vary over time with market conditions.

BNPP may license the BNPP Multi-Asset Trend Index to one or more companies (each, a “Company”) for use in a product offered or issued by the Company. The products are not, in whole or in part, sponsored, structured, priced, endorsed, offered, sold, issued or promoted by BNPP or any of its affiliates, or any third party licensor of information to BNPP. BNPP reserves the right to amend or adjust the BNPP Multi-Asset Trend Index methodology from time to time and accepts no liability for any such amendment or adjustment. BNPP is not under any obligation to continue the calculation, publication or dissemination of the BNPP Multi-Asset Trend Index and accepts no liability for any suspension or interruption in the calculation thereof. Neither BNPP nor any of its affiliates accepts any liability in connection with the publication or use of the level of the BNPP Multi-Asset Trend Index at any given time.

BNPP may enter into derivative transactions or issue financial instruments (the “Index Products”) linked to the BNPP Multi-Asset Trend Index. The BNPP Multi-Asset Trend Index Products are not in any way sponsored, endorsed, sold or promoted by the sponsor of any index component (or part thereof) which may comprise the BNPP Multi-Asset Trend Index (the “Underlying Index”) that is not affiliated with BNPP (each such sponsor, an “Underlying Index Sponsor”). The Underlying Index Sponsors make no representation whatsoever, whether express or implied, either as to the results to be obtained from the use of the relevant Underlying Index and/or the levels at which the relevant Underlying Index stands at any particular time on any particular date or otherwise. No Underlying Index Sponsor shall be liable (whether in negligence or otherwise) to any person for any error in the relevant Underlying Index and the relevant Underlying Index Sponsor is under no obligation to advise any person of any error therein. None of the Underlying Index Sponsors makes any representation whatsoever, whether express or implied, as to the advisability of purchasing or investing in, or assuming any risk in connection with, the BNPP Multi-Asset Trend Index Products. BNPP shall have no liability to any party for any act or failure to act by any Underlying Index Sponsor in connection with the calculation, adjustment or maintenance of the relevant Underlying Index and have no affiliation with or control over any Underlying Index or the relevant Underlying Index Sponsor or the computation, composition or dissemination of any Underlying Index. Although BNPP will obtain information concerning each Underlying Index from publicly available sources that it believes reliable, it will not independently verify this information. Accordingly, no representation, warranty or undertaking (express or implied) is made and no responsibility is accepted by BNPP as to the accuracy, completeness and timeliness of information concerning any Underlying Index.

BNPP may act in a number of different capacities in relation to the BNPP Multi-Asset Trend Index and/or products linked to the BNPP Multi-Asset Trend Index, which may include, but not be limited to, acting as hedging counterparty, index sponsor and/or index calculation agent.

© BNP Paribas. All rights reserved.